This CLE explores the ethical, practical and regulatory implications of integrating artificial intelligence into legal practice. It covers core technologies like machine learning and generative AI, their application in law firms and the ethical responsibilities attorneys under the ABA Model Rules and various state bar ethics opinions.

Drawing from decades of experience, two seasoned IP professionals explain the distinctions between utility and design patents, the benefits and limitations of provisional applications and the strategic application of trade secrets. Through numerous entertaining case studies and real client stories, this session offers insights into leveraging multiple IP tools effectively. The discussion includes legal requirements, enforcement risks, best practices and how to advise clients based on business goals and budget constraints.

California is known for having some of the strongest employee protections in the U.S., encompassing various aspects of employment. These laws cover areas like minimum wage, overtime pay, meal and rest breaks, paid sick leave, family leave, and protection against discrimination and harassment. The California Fair Employment and Housing Act (FEHA) offers broader protection than federal law, including additional protected classes like sexual orientation, gender identity, and immigration status, according to the Civil Rights Department.

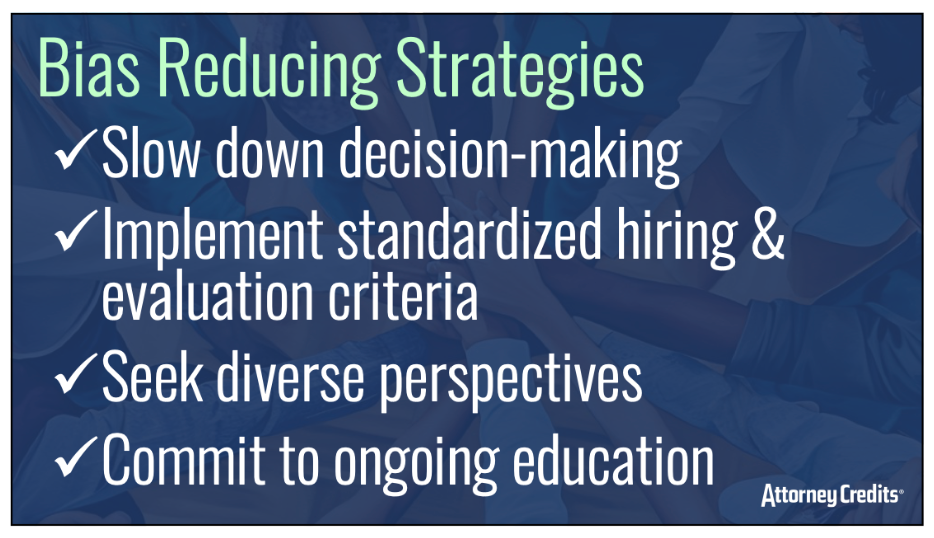

In this highly practical CLE, Employment Law Litigation attorney Mila Arutunian shares her experience & guidance on how companies can avoid unconscious bias in hiring and recruiting potential employees. Mila will mainly discuss the following topics: how implicit bias affects hiring and employment decisions, types of biases and how they diminish the workplace and strategies for employers to reduce bias in hiring. Types of biases discussed: categorization, stereotyping, halo/horn effect, affinity bias and confirmation bias.

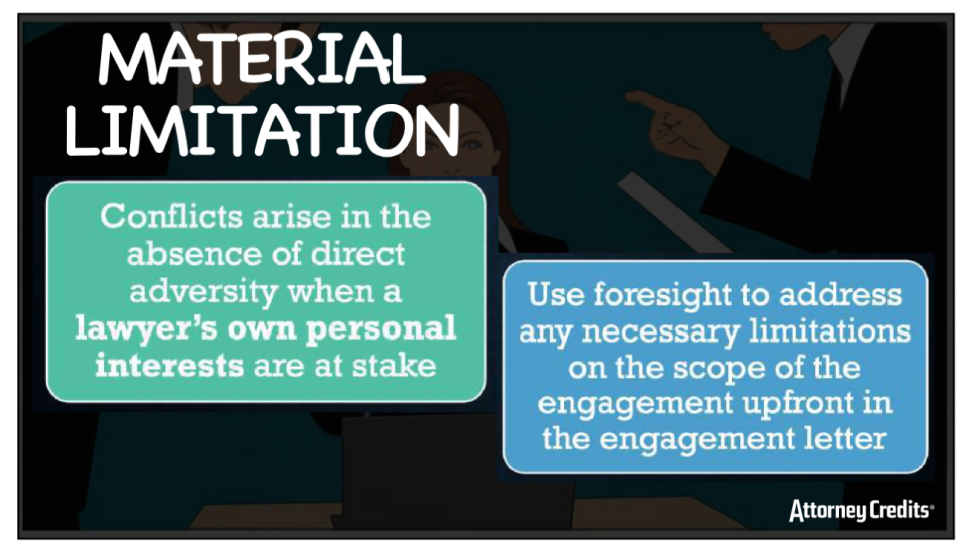

In this CLE, ethics expert & Professor of Legal Ethics Cari Sheehan will mainly discuss the ethical framework regarding conflicts of interest, practical steps to avoid conflicts of interest and specific scenarios in your legal practice where conflicts occur. The steps to conflicts of interest resolution discussed: (1) identifying if it’s a current, former or prospective client, (2) analyzing whether a conflict exists, (3) determining if the conflict is consentable, (4) obtaining informed consent, and (5) remedies if the conflict is not resolved.

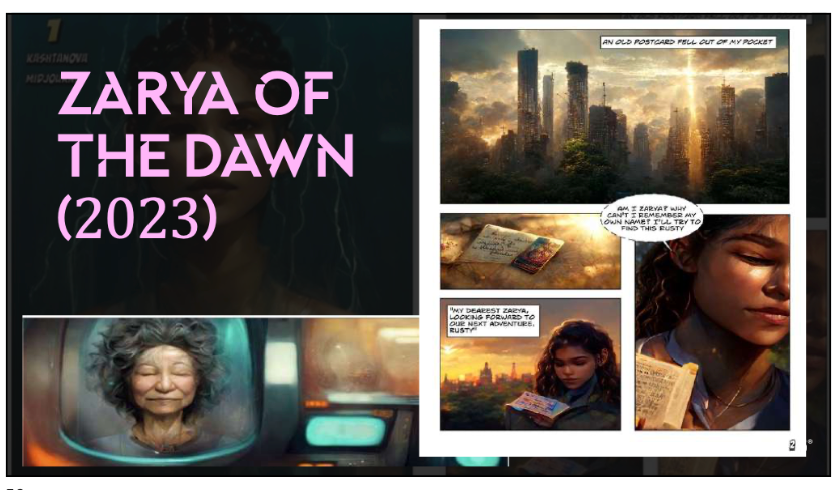

“Of Monkey Selfies & Machines learning.” Attorney Scott Sholder will dive into cutting edge copyright issues of authorship, ownership & protectability of AI generated content when generative AI is used to generate content and works of art. Scott will mainly cover: Copyright Basics, Copyright Registration and Generative AI: Authorship & Copyrightability.

Nate Osborn often recommends a very practical solution that offers asset protection & tax benefits – the LLC. In this CLE he provides practical guidance on how to draft a real estate limited liability company (LLC) operating agreement. Main topics: asking the right questions, determining whether an LLC is the appropriate entity for your client, selecting a member or manager managed LLC, maximizing personal asset protection through the LLC, drafting capital contribution provisions, drafting real estate profit distribution provisions, drafting dispute resolution provisions and tax implications & how to maximize tax benefits.

Generative AI is one of the hottest topics due to its ability to create new content like text, images, and videos based on existing data patterns, leading to potential revolutionary applications across various industries. Attorney Scott Sholder will dive into these novel & cutting edge copyright issues of authorship, ownership & protectability of AI generated content when generative Artificial Intelligence (AI) is used to generate content and works of art.

In this CLE, Ron Daniels turns things around and provides professionalism lessons from lawyers behaving badly. The case examples analyzed: the attorney who pooped in the pringles can, lawyers & unprofessional emails, a defense attorneys unprofessional use of AI, unprofessional conduct at deposition and unprofessional conduct on social media.

Attorney and CPA Gary Fletcher will provide background on the Corporate Transparency Act & the BOI Report (Beneficial Owner) process and how you and your client’s duties as an estate planner & business owner will be impacted by the beneficial ownership information reporting requirement under the Corporate Transparency Act (CTA). The rule requires certain corporations, limited liability companies and other entities to report information to FinCEN about themselves, their beneficial owners – and in some cases, their company applicants.