California has a new bar exam! The California Supreme Court, on Tuesday October 22, 2024, overturned their previous denial and has given the approval for California to switch to a new bar exam that can be taken remotely and in-person. The State Bar of California has been working on the new test for over a year, and on the second try, the…

In the dynamic realm of law, staying on top of the latest developments and honing one’s skills is crucial for professionals to thrive. Paralegals, often considered the backbone of legal teams, play a pivotal role in supporting attorneys and ensuring the seamless operation of legal practices. In the state of California, the pursuit of excellence for paralegals is further underscored by the…

Stay Informed on the Latest Change to California MCLE Late Penalties As of mid-2023 The State Bar of California raised the Minimum Continuing Legal Education (MCLE) noncompliance late fees. The State Auditor and the Board of Trustees decided that overall administrative revenue wasn’t enough to cover the rising costs of service, so they voted to raise your fees. Late Fee Penalty from …

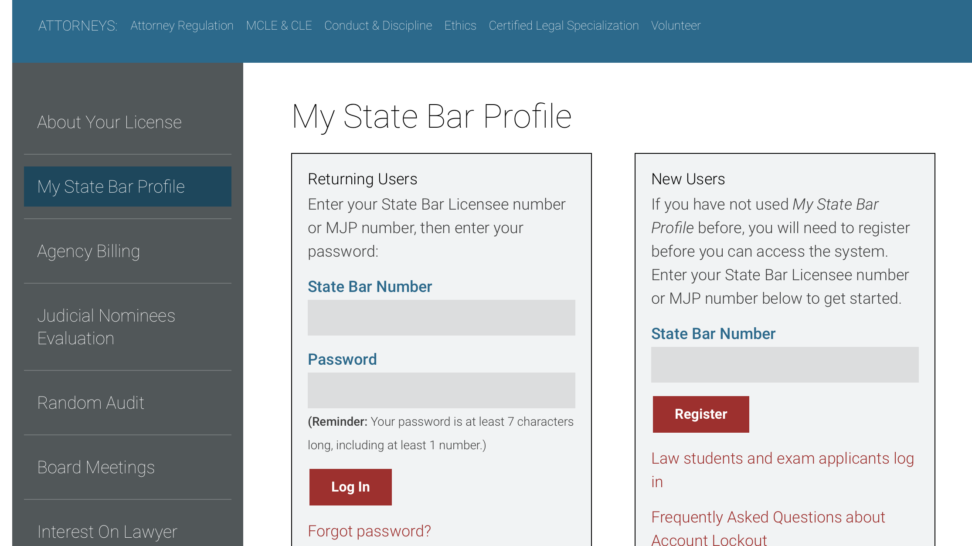

California attorneys may no longer submit a paper compliance card, attorneys must now report their compliance online through My State Bar Profile.

You get a frantic call from an attorney you’ve known since law school. Apparently, a person that she declined to represent left scathing, false reviews with one stars on a number of review websites like Yelp and RipoffReport.com. She is extremely distraught since she relies in the Internet for new clients and she wants your advice on what to do. Handling Online…

In this CLE tax crash course Sam Brotman details how you can help the businesses you counsel spot tax issues before they become major headaches.

If you comply with the California MCLE requirement by June 30, you do not need to request an extension of time. You will be assessed a late fee of $75.

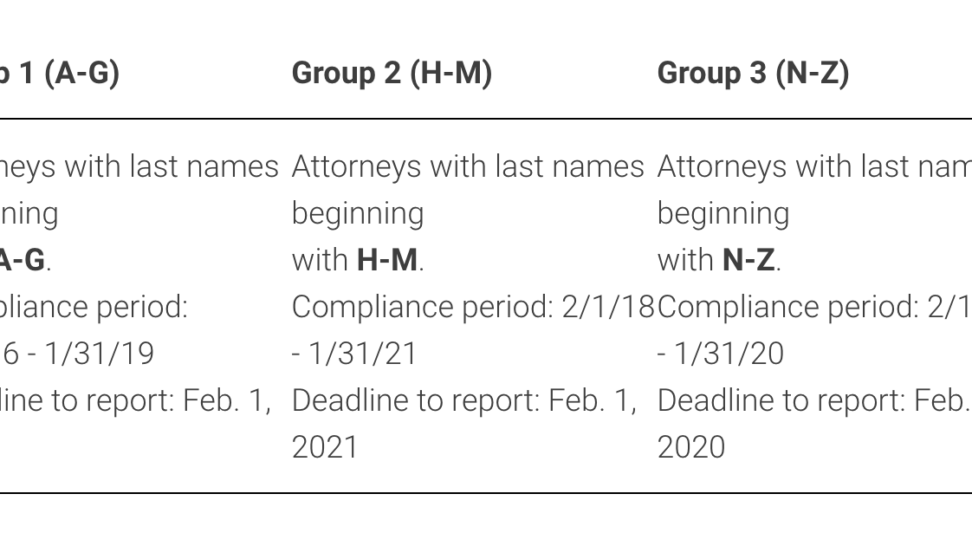

California attorneys must complete 25 hours every 3 years.

California attorneys with last names A-G must complete and report 25 CA MCLE hours by February 1, 2019.

Franchise law is a specialized area of law that is fairly regulated by both federal law and various state laws. Knowing the intricacies of how franchising and franchise law work can enhance your skill sets as a practitioner and help you better assist your business clients. Franchise Disclosure Document (FDD) The Franchise Disclosure Document (FDD) must include 23 items and it includes…