Attorneys in Illinois are required to report MCLE compliance every two years by June 30. The two-year compliance cycle runs from July 1 to June 30. If your last name is A-M your MCLE compliance deadline is in even years and if your last name is L-Z your compliance deadline is in odd numbered years. The upcoming June 2024 deadline is for…

An in-depth review of the pre-due diligence process can maximize business value and ensure a seamless sale and transition. This CLE course presents a proven process that evaluates potential risks, validates investment return and identifies opportunities to enhance business value in preparation for business sale or transition.

Unconscious bias can lead to bad decisions that violate an attorneys’ ethical duties of Competence, Communication & Diligence. It can also lead to bad press for law firms, malpractice lawsuits and possibly disbarment.

From Letters & Faxes – To Tik Tok & X Only a few years back, lawyers wrote letters, sent faxes and relied on their reputation for integrity & intelligence to gain clients. Nowadays, attorneys send emails, tweet and advertise on Google, Facebook and Tik Tok. Professionalism & Civility in the Legal Profession With the advent attorney advertising in the 1980’s, bar associations…

Just in case you forgot what the Illinois CLE requirements and rules regarding reporting are, here is a short recap for you. With the 2024 deadline only a few months away, it’s time to get a jump start on your IL CLE. Illinois CLE Details The Illinois CLE requirements for the 2022-2024 reporting period are 30 total CLE credit hours. Of these…

At Attorney Credits you can complete one course and get credit for multiple states. We offer courses in 49 states plus DC and Puerto Rico, so as long as you don’t need Wisconsin CLE, we have your covered. Getting credit for two or more states can be confusing to newcomers, but in this blog post, I will try to explain how easy…

Todd Fichtenberg will walk you through the wonderful world of trademarks and trademark law protections. Todd will mainly talk about what every attorney needs to know about trademarks, how trademarks protect brands in today’s marketplace and counseling your clients on trademark registration and protection. Todd will also cover recent case law involving: Starbucks, Mutual of Omaha, Chewy Vuiton, NFTs, Jack Daniel’s, Walmart vs. Kanye West (Yeezy) and Nike vs. StockX.

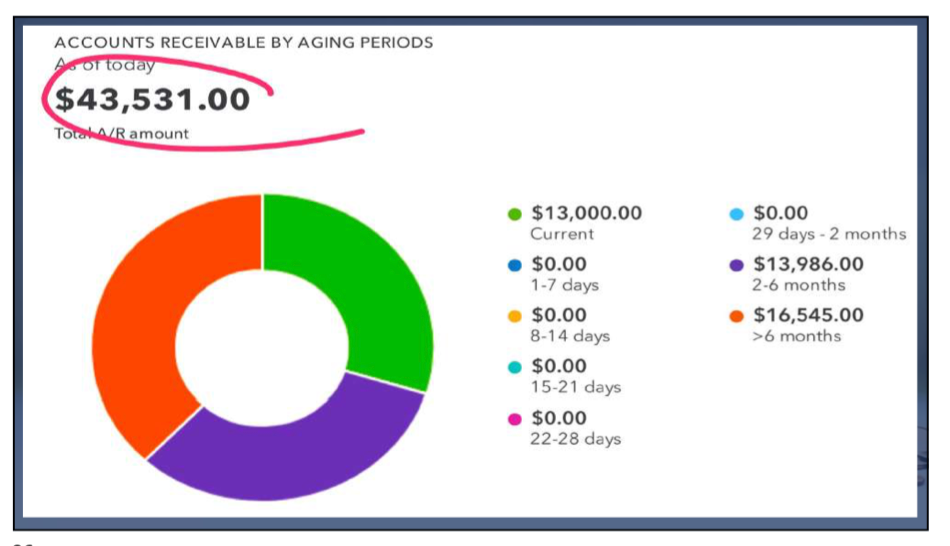

What should go into an IOLTA Account… what should NOT go into an IOLTA Account? What is good recordkeeping? And why do I always have a negative balance? Jessica Zoraida will answer all your key trust accounting questions and show you the best practices to remain compliant in your legal practice. The bottom line for attorneys: it pays to know the basics of trust accounting.

Are you familiar with the Hero’s Journey, archetypes and universal story themes? Powerful storytellers use time-tested techniques to weave engaging stories and attorneys can deploy these to build rapport to help persuade the judge & jury.

A Special Needs Trust (SNT) allows for a disabled person to maintain his or her eligibility for public assistance benefits, despite having assets that would otherwise make the person ineligible for those benefits. These types of trusts are a vital component of estate plans when clients have beneficiaries with disabilities.