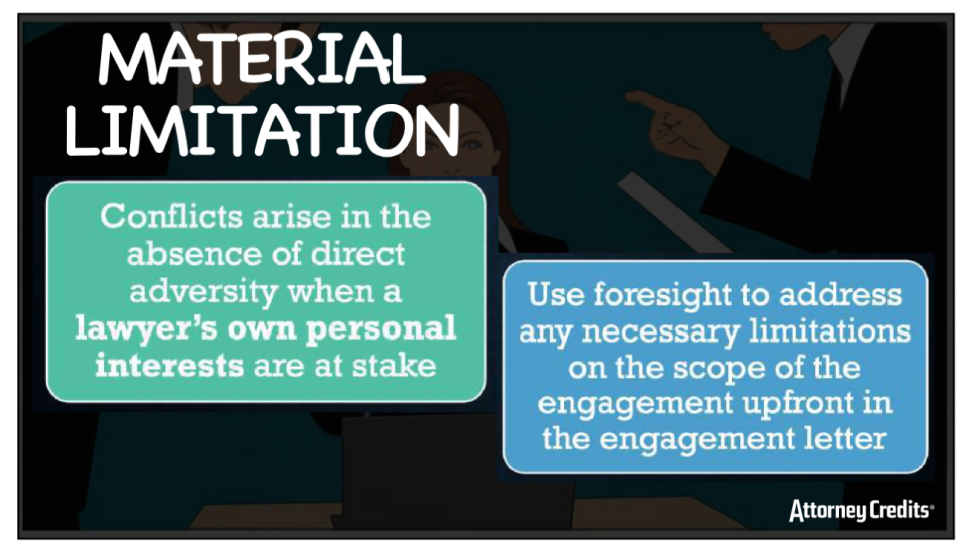

In this CLE, ethics expert & Professor of Legal Ethics Cari Sheehan will mainly discuss the ethical framework regarding conflicts of interest, practical steps to avoid conflicts of interest and specific scenarios in your legal practice where conflicts occur. The steps to conflicts of interest resolution discussed: (1) identifying if it’s a current, former or prospective client, (2) analyzing whether a conflict exists, (3) determining if the conflict is consentable, (4) obtaining informed consent, and (5) remedies if the conflict is not resolved.